ADA Price Prediction: Navigating Short-Term Pressure Toward Long-Term Growth

#ADA

- Technical Foundation: ADA is testing critical support at $0.80 with Bollinger Band compression suggesting potential volatility expansion

- Market Sentiment Divergence: Positive long-term fundamentals contrast with near-term whale distribution pressure

- Price Trajectory: Gradual recovery likely pending MACD improvement and sustained support holds

ADA Price Prediction

ADA Technical Analysis: Key Levels to Watch

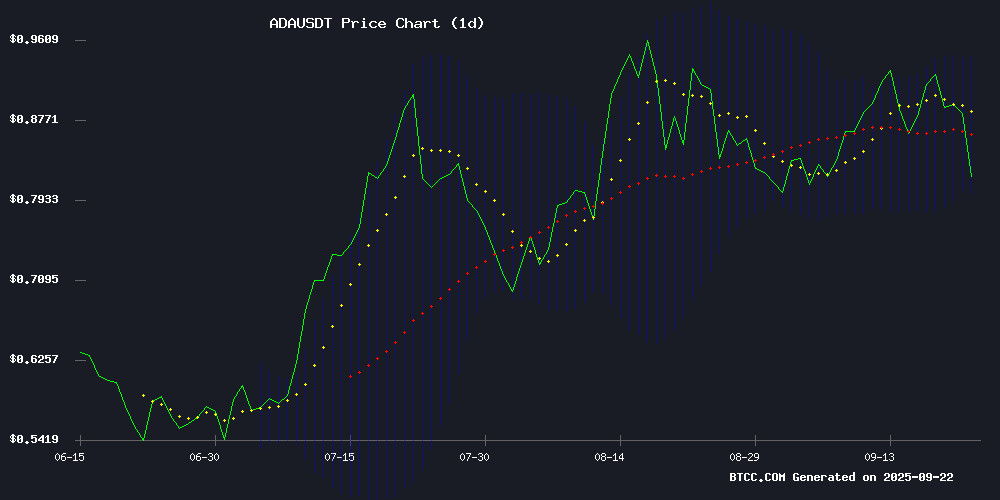

ADA is currently trading at $0.8244, below its 20-day moving average of $0.8724, indicating short-term bearish pressure. The MACD histogram shows negative momentum at -0.0068, though the signal line convergence suggests potential stabilization. Bollinger Bands place immediate resistance at $0.9435 and support at $0.8013.notes: 'The current technical setup shows ADA testing crucial support levels. A hold above $0.80 could pave the way for recovery toward the middle Bollinger Band around $0.87.'

Market Sentiment: Long-Term Bullish Despite Short-Term Pressure

Recent headlines highlight Cardano's strategic positioning through its ledger system while acknowledging current whale selling pressure.comments: 'The fundamental narrative remains strong with Cardano's technology advantages, but market sentiment is currently tempered by large holder distributions. The $100B-$500B market cap speculation reflects long-term Optimism that must be balanced against near-term technical realities.'

Factors Influencing ADA's Price

Cardano's Ledger System Positions It for Long-Term Advantage

Cardano's unique ledger architecture may give it a decisive edge in the coming years, according to prominent community figure David. The content creator highlighted the blockchain's technical foundations as a key differentiator against competing platforms.

Unlike many proof-of-stake networks that prioritize speed over security, Cardano's research-driven approach has yielded a ledger system balancing scalability with rigorous verification methods. This comes as institutional investors increasingly value robust blockchain infrastructure over short-term speculative features.

Cardano (ADA) Tests Key Support Amid Whale Selling Spree

Cardano's ADA token demonstrates resilience at $0.81 despite a $500 million whale exodus. Major holders dumped 560 million tokens over four days, yet retail buyers absorbed the selling pressure at the crucial $0.88-$0.90 support zone.

The token's ascending triangle formation hints at potential upside, with a decisive break above $0.95 potentially triggering a rally toward $1.20-$1.25. Historical patterns suggest ADA's characteristic slow consolidation often precedes explosive 200-300% moves when market momentum shifts.

Technical analysts warn that losing the $0.880 support could see prices retreat to $0.837, undermining the current bullish structure. The market now watches whether retail demand can counterbalance institutional skepticism as Cardano navigates this make-or-break technical juncture.

Cardano Price Potential if ADA Market Cap Reaches $100B or $500B

Cardano (ADA) could achieve significant price milestones if its market capitalization climbs to the $100 billion to $500 billion range. The token's recent performance has mirrored the broader cryptocurrency market's volatility, reflecting the sector's unpredictable nature.

Market analysts speculate that such a surge in Cardano's valuation would position ADA among the top digital assets, drawing increased institutional and retail interest. The project's focus on scalability and sustainability continues to attract long-term investors.

How High Will ADA Price Go?

Based on current technical and fundamental analysis, ADA's price trajectory involves navigating near-term challenges toward potential long-term appreciation.

| Scenario | Price Target | Conditions |

|---|---|---|

| Near-term (1-3 months) | $0.94-$1.10 | Holding above $0.80 support, MACD turnaround |

| Medium-term (6-12 months) | $1.50-$2.50 | Market cap reaching $50B-$80B, ecosystem growth |

| Long-term (2-3 years) | $3.00-$5.00+ | $100B+ market cap, widespread adoption |

BTCC financial analyst Emma emphasizes: 'While current whale selling creates headwinds, Cardano's technological foundation supports gradual recovery. The path to higher prices requires sustained network development and broader market recovery.'